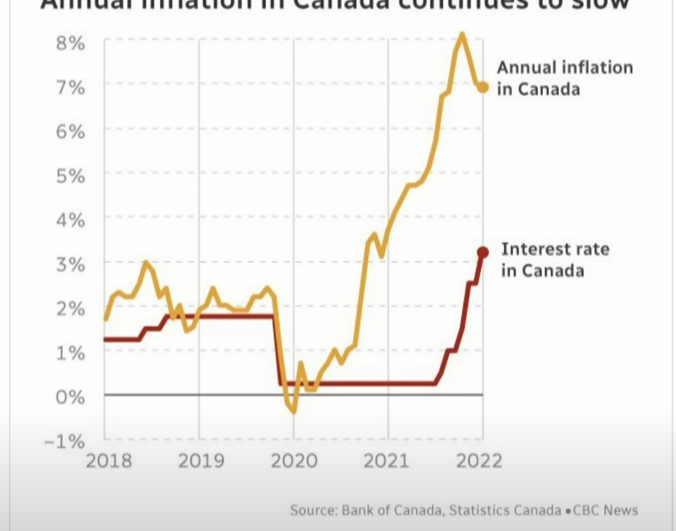

It is anticipated that the Bank of Canada will raise the interest rate on Wednesday of this week, and the rise will likely be significant. According to the opinions of the vast majority of experts, it may push the total interest rate up to 4%. A growing number of Canadians believe that rising interest rates are troublesome this morning, despite the fact that the central bank has been hiking the rate in order to reduce inflation. In a recent study conducted by MNP, it was found that six out of ten Canadians are worried about the effect that increased interest rates would have on their current financial conditions and that 84 percent of them say they are being more cautious with how they spend their money as a result. In addition, it highlights that those in Canada with lower incomes and renters are more susceptible to the impact of increasing interest rates.

I recommended that you check out “mind your business,” the title of Peter Armstrong’s weekly online newsletter, which can be found on his website. One issue being discussed is inflation. He is under the impression that there will be another disproportionate rise. The fundamental issue is whether the bank will make a .50 basis point or if it will be closer to .75 basis points. There has even been speculation of a full one percentage point increase in the base rate. This would be another significant step, and the issue is whether the bank wants to stay ahead of this so that it can slow down and not have to conduct any more interest rate rises in the future.

What is to come this week

- We’ll get a ton of information about the state of the economy.

- We’re going to get a ton of new data, not just about where the economy is but the impact of the decisions we’ve been making.

- Bank Canada on Wednesday.

- We’ve got GDP numbers on Friday.

This will show how the economy began to react to those interest rate hikes we have seen come so fast and so sharp.

We also get some job data. We’ve lost 95000 jobs just since the beginning of June.

Does this suggest a more fundamental problem in the economy?

This is because the instrument they use to lower prices will, by necessity, have a chilling effect on the economy.

It’s causing people to put off buying things like fancy dinners and new pants. However, if these choices are applied to a population, the economy would slow down rapidly and significantly.

The challenge was whether or not they could do this without putting the economy into recession, and the latest projections indicate that they will. So we are entering a period of economic contraction. So this is a critical week of data coming up that will show us the economy’s trajectory, maybe towards the end of this year but more likely at the beginning of next year.

In most cases, monetary policy interest rate rises take about 18 months to filter through to the economy. Therefore, a decline in the rates should be seen favorably. However, although inflation has decreased somewhat from its peak of 8.1% in June, it still seems stubbornly high, and in certain areas, core inflation is still growing. That’s an issue, then.

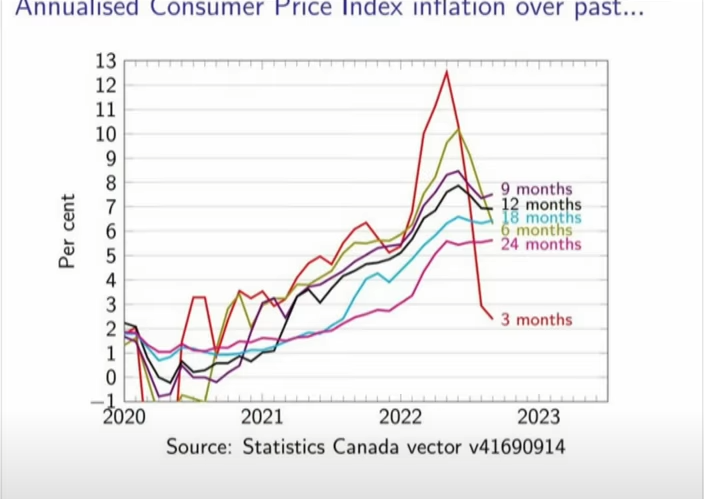

Chart from Steven Gordon, an economist at Laval University in Quebec, who has been watching shorter-term patterns and saw a significant uptick. Therefore, if you look at shorter-term patterns, such as those over the last three, six, or nine months, you’ll see that the three-month average is plummeting. And thus, it seems like some headway is being made. However, the major headline year-over-year comparison has not yet reflected this. People should take solace in the fact that it is working, even if the Bank of Canada thinks they need to make another supersize cup because it isn’t functioning fast enough.

Is a boost in interest rates really what we need right now?

The nation’s central bankers almost unanimously agree that we do. However, economists have expressed their belief that this is not the case. It would be beneficial if you could stop putting the economy into a recession. However, the argument from the perspective of the central bank is that the health of the economy and the people who participate in it would benefit more from a mild and temporary slowdown in economic activity that borders on but does not entirely enter a technical recession. Then longer dealing with inflation, and if you’ll let that get it in control and it becomes de-anchored from inflation expectations, then it’s going to get a lot harder, and the tricks and tools they have to bring it down become a lot more painful. If you let that get out of control, it will get much harder. They argue that we may forestall significant suffering in the future by accepting moderate discomfort in the here and now. A short-lived mild recession is a chance, and they believe that once you start decreasing an economy, it doesn’t take much to shift it into something an awful lot deeper and much more painful.