One of the keys to success is Buying the dip.

So let’s look at five fundamental rules you can implement to help you invest during this market downturn.

1. Avoid Panic Selling a Good Business

What you need to be aware of when buying a stock. Is that what you are buying as part of a business? The longer you hold your stock, the less risky it becomes. Whereas the longer the maturity of a bond, the riskier it becomes.

Example: you buy your house for $500,000, your neighbor offers you 400,000 one day after you bought it, and each day forward offers you less and less. The housing market is not going so well, and your neighbor again asks. Hey, ill buy your house, and this time he offers $100,000. Are you going to sell him your home? Of course, not well it’s the same thing with stocks. If you buy a stock that goes lower and it’s a good solid business, it will eventually rebound.

However, if there has been a fundamental shift, you should consider selling your shares. If the price decline is attributable to a factor that permanently damages the business’s ability to create cash flow in the future, selling the company shares may be the best option. Therefore, it is illogical to sell a firm you have thoroughly researched and are confident in because the price could fall lower along with the rest of the market.

The time you still have to live is another consideration here. Because of the unpredictability of the market and the passage of time, elderly investors may choose to sell their stocks during a recession rather than wait the ten to twenty years it could take for their investments to return to their pre-crisis levels. In this regard, the specifics of each individual situation may vary.

2 Market Crashes are infrequent opportunities to invest.

“Big opportunities in life must be seized. We don’t do very many things, but when we get the chance to do something that’s right and big, we’ve got to do it. And to do it on a small scale is just as big a mistake as not doing it at all.” Warren Buffet

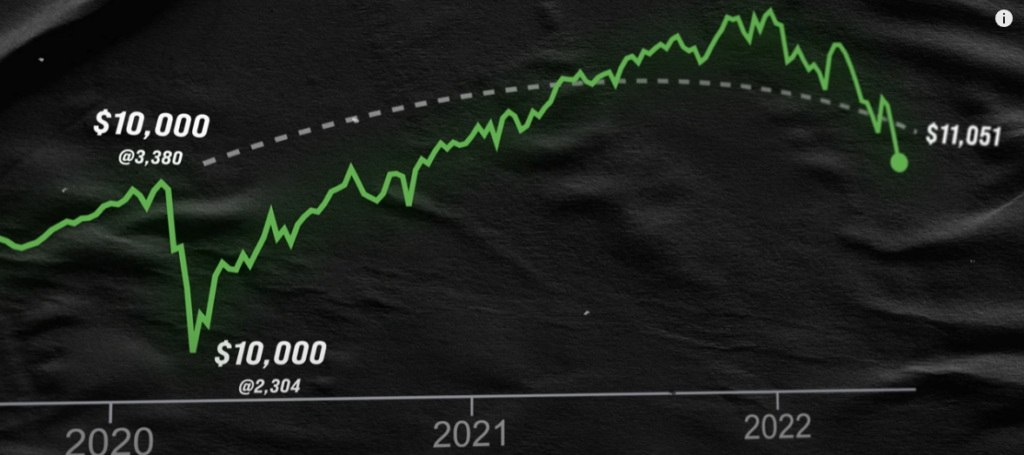

This is where you want to take full advantage when the market dives and loses 30, 40, 50% plus percent. But, unfortunately, those events happen very infrequently. So when they happen, it’s time to catch the moment and invest at different intervals because it’s hard to say where the bottom is.

- Let’s say you invested $10,000 into the market at the highest point @ $3,380

- Today you would have $11,051 = 10.51% return

- But if you invest your $10,000 at the bottom @ $2,304

- Today you would have $16,198 = 62% return in 2 years.

So if you have a low stock market jumping out at you, this is where you need to take your opportunity.

3. What do you buy in these rare opportunities?

You need to understand what the economics of the business are likely to look like 10 years or 20 years from now. Warren’s example is, I know what wriggles chewing gum will look like 10 years from now. The internet isn’t going to change the way people chew gum. It will not change which gum they chew. Even if there is some competition for wriggles chewing gum, his projections for this product will not be far off. He understands what the company does and the aspects of the business; therefore, he sticks to what he knows.

You should never invest in an individual company if you don’t understand it, regardless of how cheap it is. So stick to what you know and do your homework. Defining your circle of competence is the most important aspect of investing. It’s not how large your circle is. You don’t have to be an expert on everything. But knowing where the perimeter of that circle of what you know and what you don’t know is and staying inside is all important. “warren buffet.”

I do not give financial advice, but a wise person once told me you could never go wrong on the SPY, QQQ, or the S&P500, devised by all the top-performing companies if you don’t have an individual company you want to invest in.

4. Avoid sorting your buy list by cheapest.

The quality of the company should be a primary consideration when organizing your watch list. Rather than purchasing a mediocre company at a fantastic price, acquiring a great company at a reasonable price is preferable. You want to put your money into high-quality companies that will compound internally and be held for decades. Not cheap, but following a market crisis, you could preserve as much as half of the stock’s worth.

What to look for in a business you may want to invest in

- Ample cash

- Low debt

- Strong competitive advantage

- Excellent return on investor capital

- Great growth

5. Always stay focused on the long term.

When the market crashes, the herd loses all rationality and starts panicking, which triggers a downward cycle as more people try to sell simultaneously. If you’re the type to invest for the long haul, your money will still be in the market 10 years from now. Investing in downturns is simpler if you accept that you will be in it for the long haul. Investing your money at a low rate of return without monitoring or checking on it guarantees a profit in the long run, whether you retire in ten years, twenty years, or thirty years from now.