What is digital currency banking?

A Central Bank Digital Currency (CBDC) refers to a digitized form of a nation’s official currency, serving as a representation of physical cash while embodying a direct claim on the central bank. In contrast to traditional currency printing methods, CBDCs are presented as electronic coins or accounts, supported by the unwavering trust and credit of the government.

Why would the government get involved?

There are multiple reasons why exploring digital currencies is important, and different countries have their own unique motivations for launching Central Bank Digital Currencies (CBDCs) based on their economic situations. Some of these reasons include:

- Promoting financial inclusion: CBDCs aim to provide accessible and secure means of accessing money for individuals who are unbanked or underbanked, ensuring that they have equal opportunities to participate in the financial system.

- Introducing competition and resilience: CBDCs can bring competition and increased resilience to the domestic payments market by incentivizing providers to offer more affordable and improved access to financial services.

- Enhancing payment efficiency: CBDCs have the potential to make payments faster and more efficient, reducing transaction costs and streamlining the overall payment process.

- Creating programmable money: CBDCs offer the possibility of programmable features, allowing for advanced functionalities such as smart contracts, automated transactions, and conditional payments.

- Improving transparency of money flows: CBDCs can enhance the transparency of financial transactions, making it easier to track and monitor the flow of money, which can help in combating illicit activities.

- Ensuring seamless money flow: CBDCs aim to facilitate smooth and frictionless money transfers, enabling swift and convenient transactions both domestically and internationally.

These reasons illustrate the diverse benefits that countries hope to achieve by exploring and implementing CBDCs, which range from inclusive financial systems to improved efficiency and transparency in monetary transactions.

Some of the challenges

The introduction of new payment systems has implications that directly impact people’s daily lives and can potentially pose challenges to a nation’s national security objectives. For instance, these systems might hinder the ability of the United States to track cross-border transactions effectively and enforce appropriate penalties. Additionally, there could be long-term geopolitical consequences if the U.S. fails to take a leading role in establishing standards, especially considering China and other countries’ advantage as early adopters of Central Bank Digital Currencies (CBDCs). The GeoEconomics Center’s focus on digital currencies lies at the crossroads of the future of money and national security, recognizing the significance of these developments in shaping both aspects.

What are the national security implications of a CBDC?

When new payment systems emerge, they have ripple effects that impact people’s daily lives and can potentially pose risks to a nation’s national security objectives. For example, these systems may hinder the United States’ ability to effectively track cross-border transactions and enforce penalties when necessary. Furthermore, the absence of U.S. leadership and establishment of standards could have long-term geopolitical consequences, especially if countries like China maintain their early advantage in developing Central Bank Digital Currencies (CBDCs). The GeoEconomics Center focuses on the critical connection between digital currencies, the future of money, and national security, recognizing the significance of this intersection.

What is the Fednow program?

FedNow is an instant payment service developed by the United States Federal Reserve Bank (Fed). The FedNow Service, or FedNow for short, is designed to offer uninterrupted 24/7/365 processing. In addition, it will feature integrated clearing functionality, enabling financial institutions to deliver end-to-end instant payment services to their customers.

What are instant payments?

Instant payments refer to any account-to-account financial transfer that immediately makes funds available to the transaction’s recipient. Payments are often processed in a couple of seconds. However, time may vary depending on the plan. Instant payments are also widely referred to as immediate or real-time payments for similar reasons. Instant payments are advantageous due to their irrevocability, ability to provide extensive data, and 24/7 availability.

How does FedNow differ from Fedwire?

The Fedwire Payments Service is a real-time gross settlement system that facilitates the movement of funds electronically between banks, corporations, and government organizations. Fedwire can deposit and settle payments instantly; however, Fedwire has restricted availability and can only handle payments on specified business days and during business hours. FedNow, on the other hand, is accessible 24/7, 365 days a year, and is not subject to nighttime, weekend, or holiday limitations.

However, it is crucial to remember that FedNow transactions have a maximum value, but FedWire does not, although your bank may impose a restriction.

Who will be eligible to participate in FedNow?

“As with other Federal Reserve Bank services, the FedNow Service will be accessible to depository institutions entitled to have accounts at Reserve Banks under relevant federal legislation and Federal Reserve regulations, policies, and procedures. Participants can designate a service provider or agent to submit or receive payment instructions on their behalf. If they so want, participants will be allowed to settle payments in the account of a correspondent. Merchants, customers, and nonbank payment service providers may access the service via depository institutions, as with other payment systems.

Why is the Federal Reserve Bank developing FedNow?

With a predicted compound annual growth rate of 23.6% between 2020 and 2025, instant payments are one of the fastest-growing types of digital payments. More than 50 national central banks have already built instant payment networks that provide the quick posting and settlement of payments.

Consumers and businesses in the United States currently have access to immediate payments via Zelle and the RTP® Network, privately owned and managed by Early Warning Services, LLC and The Clearing House, respectively. However, in 2013, the Fed started exploring adopting a centrally owned and run quick payments network. As a result, in 2015, it established the Faster Payments Task Force (FPTF) to evaluate possibilities for implementing immediate payments.

In its 2017 final report, the FPTF voted decisively in favor of creating a network and provided implementation suggestions to ensure its success. In 2018, the U.S. Treasury provided its formal support for an immediate payments network, and in 2019, the Federal Reserve Board stated that the FedNow Service would begin development.

In the end, the Fed is building FedNow to enable financial institutions of all sizes throughout the United States to provide secure and efficient rapid payment services to clients.

Will FedNow replace the ACH Network?

FedNow will not replace the Automated Clearing House Network (ACH); instead, it is planned to enhance ACH services.

ACH is an electronic money transfer network for consumers, companies, and federal, state, and municipal governments in the United States. It is often used for direct deposit and direct payment procedures. ACH transfers may generally be completed within one to three business days.

Same-day ACH was launched in 2016 by the National Automated Clearing House Associations, or NACHA, the group responsible for ACH governance. Same Day ACH, as the name indicates, posts and settles payments on the same day they originated – a significant improvement but not instantaneous. Due to this, Same Day ACH is not considered an immediate payment mechanism but a speedier payment system.

FedNow is not intended to replace ACH or Same-Day ACH but rather to offer increased redundancy for payment processes, minimizing payment network bottlenecks. The Fed plans to develop payment interoperability between FedNow and ACH in the long run.

What does the Fednow payment flow look like

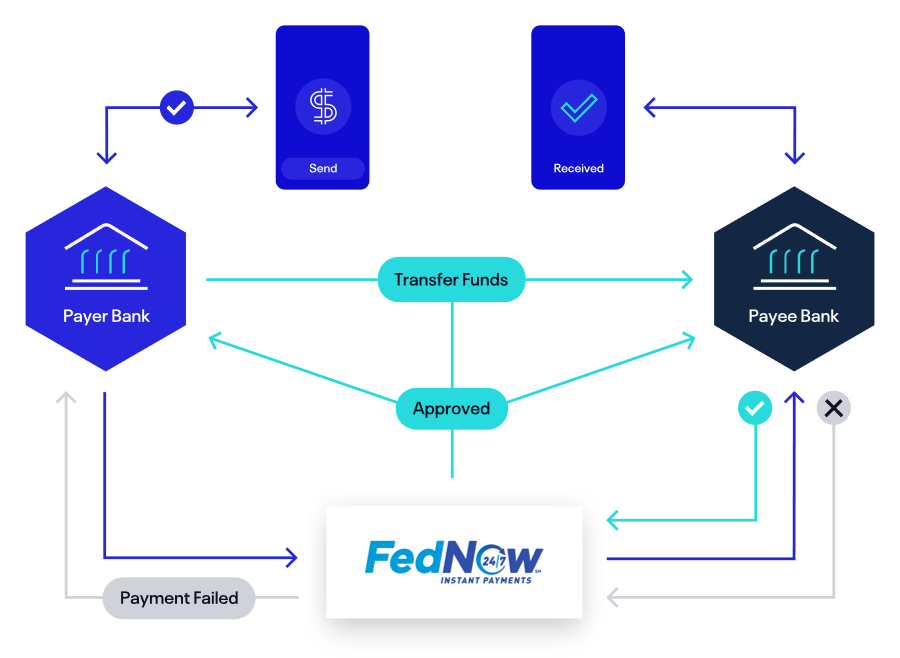

A FedNow payments flow is comparable to any other immediate payments flow, beginning with the parties: a payer, the payer’s financial institution, the FedNow network, a payee, and the payee’s financial institution.

The basic procedure is as follows:

- A payer begins a payment by sending a payment message to their financial institution outside FedNow.

- The payer’s banking institution gets the payment instruction and approves the transaction if the payer has adequate money in their account.

- The banking institution of the payer transmits a payment message to the FedNow Service.

- FedNow verifies the payment message and transmits its contents to the payee’s banking institution for approval or rejection.

- The payee’s financial institution responds to FedNow by approving or refusing the payment. FedNow will inform the payer’s financial institution of payment failure if the payee’s financial institution rejects the message. In addition, if the payee’s financial institution accepts the message, FedNow automatically deducts monies from the payer’s account and posts them to the payee’s account.

- FedNow notifies all parties of the successful money transfer, at which point the transaction is concluded.

How will financial institutions benefit from FedNow?

The Fed’s announcement of its intentions to create the FedNow Service elicited encouraging responses from the industry, with the general belief that the new service would be a beneficial catalyst for the market’s acceptance of prompt payments.

FedNow will likely:

- Increase fair access for all companies and consumers by making fast payment technology available to a broader audience, including local community banks.

- Reduce banks’ and other nonbank financial firms’ total payment processing expenses.

- Provide fast access to pay stubs and other electronic financial transfers for enhanced cash flow management.

- Optimize a company’s liquidity management and cash flow forecasts, allowing them to control operational expenditures better and retain strong vendor relationships.

- Conform to the new ISO 20022 standard, allowing participants to transmit and receive rich data, including RfP and non-value message types.

- Promote immediate payment security by creating industry-wide standards for contesting fraudulent transfers, ISO 20022 conformance, and payment authentication.

Don’t forget to follow my Facebook or Twitter account

https://www.facebook.com/profile.php?id=100085540707736

https://twitter.com/DallierMic60307

References

- “Digital Currencies, National Security, and Geopolitical Ramifications” – A research paper by the National Bureau of Economic Research (NBER) that explores the potential national security implications of digital currencies and the geopolitical consequences of their adoption.

- “Central Bank Digital Currencies: Risks, Opportunities, and National Security Implications” – A report published by the Center for a New American Security (CNAS) that examines the risks, opportunities, and national security considerations associated with the development and adoption of central bank digital currencies.

- “Digital Currencies and Their Impact on Financial Systems and National Security” – A policy brief by the Carnegie Endowment for International Peace, which analyzes the impact of digital currencies on financial systems and explores the associated national security challenges and opportunities.

- “The Geopolitics of Digital Currency” – An article published by the Council on Foreign Relations (CFR) that discusses the geopolitical implications of digital currencies, including the competition for influence between major powers and potential shifts in the global financial landscape.

- “Digital Currency, Financial Inclusion, and National Security” – A report by the World Economic Forum (WEF) that explores the role of digital currencies in promoting financial inclusion and the potential national security considerations associated with their implementation.